A new retail landscape will emerge driven by 6 game-changing factors:

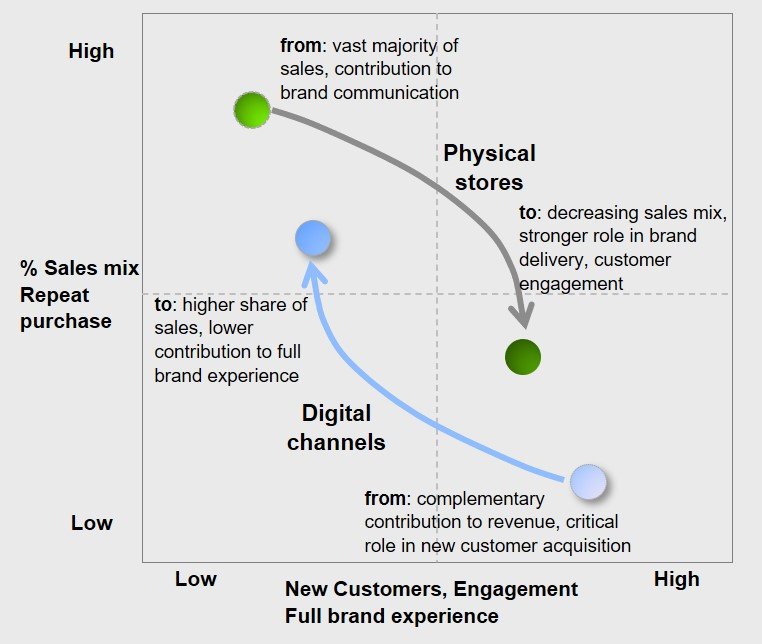

1. Omnichannel inversion: stores will become the main channel of brand delivery, customer engagement whereas digital channels will generate much higher sales

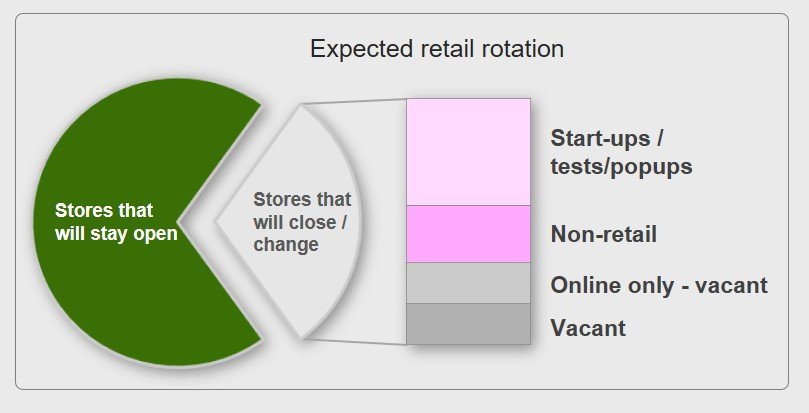

A metamorphosis of bricks and mortar and digital retail will take place. The purchase of branded products and repeat purchase will keep shifting to digital channels at faster pace than previously forecast; stores will therefore lose relevance in sales however will represent the best way to engage new customers, to deliver the story telling, to communicate differentiation and innovation. The number of stores will be reduced - Inditex just announced 1,200 stores will be shut globally – and priority will shift from the capillarity of distribution to the right locations that deliver the new priorities of the omnichannel retailing

2. Online transition: e-players acquiring bricks and mortar brands; established, struggling retailers becoming online only

E-commerce platforms will keep reinforcing their offering to extend customer base. Most common targets will be high street brands with the exclusion of physical retail network. As a result some high street brands become online only, stores are closed

3. Start ups and tests of new formats: higher number of available locations will reduce rents and encourage new ventures

. These can new concepts as The Beauty Hall from Next in the UK; innovative retail start ups targeting market niches and local customers; non-retail brands offering experiential eating, leisure, car showrooms, exhibitions, fitness centers, hotels, smart offices

4. Growth of second hand, recycle, upcycle: sustainable, transparent fashion retailing as part of circular economy

Customers will demand longer product lifecycle, extended offering of recycled, second hand, upcycled products, reduction of owned garments in exchange of higher quality and rented garments, peer-to-peer relations among individuals. As a result a growing number of highly differentiated, sustainable, transparent brands will flourish

5. Growth of in-store services: complementary to products, they will become large portion of revenue and key factors of differentiation

The quantity of products sold will most likely decrease as a consequence of changed lifestyle and more attention to environmental impact. However fewer owned products will convert into a demand for knowledge, customization, extension of product life. Typical services are maintenance, repair, classes, training, spaces rented for private use, product customization, monogramming

6. Reshoring/nearshoring suppliers to improve product quality, reduce carbon footprint, respond faster to seasonal to trends

New consumer habits and expectations will accelerate the evolution of consolidated business models. Strategies based on low price, low quality, short lifecycle, high volume, long time to market appear to be fading away in favour of more conscious product design, production, duration. Retail brands will be asked to embark on an innovative approach to product development and supplier strategy:

. New assortment and differentiation strategy

. Flexibility on styles, materials, colors, finishing

. Product sustainability

. Shorter time to market

. Fewer, strategic partners

. Faster reaction to trends